Why Axiom is successful

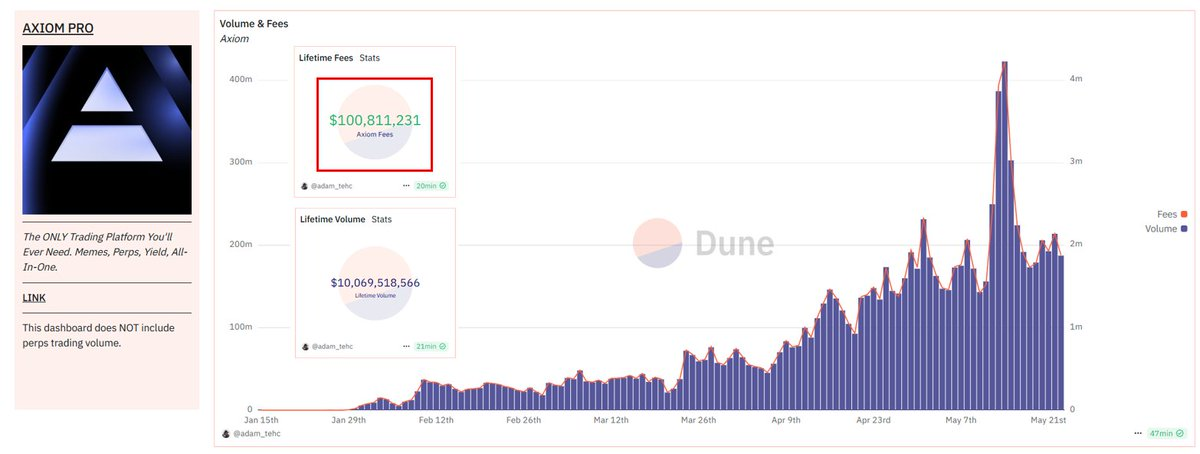

Axiom achieved something incredible. It became the fastest company in YCombinator history to reach $100m revenue in just 5 months, surpassing Cursor, which previously held the record at 12 months.

For those who have never heard of Axiom, that's normal. I'm going to explain everything you need to know, from A to Z. Be ready.

What is Axiom

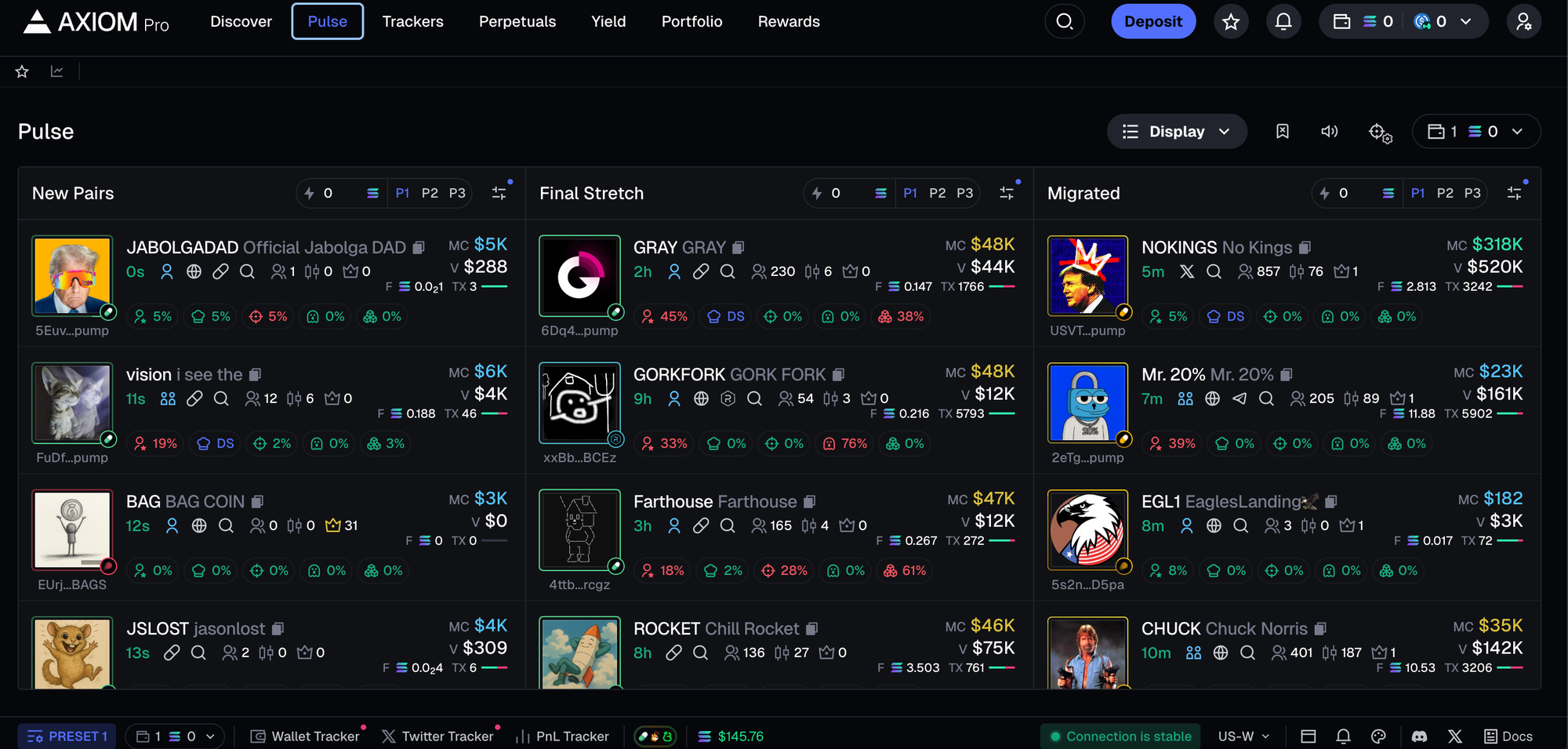

If you visit their website for the first time, you might feel overwhelmed. That's normal. Axiom is a trading platform on Solana, specialized in memecoins. Tens of thousands of new memecoins are launched every day, but only a small fraction reach the bonding curve, and even fewer hit a $10m market cap.

The entire goal is to identify, as early as possible, which memecoins are going to rise. Once you've identified one, you need to be able to buy it instantly.

That's what Axiom is all about.

The Market of trading Web-App

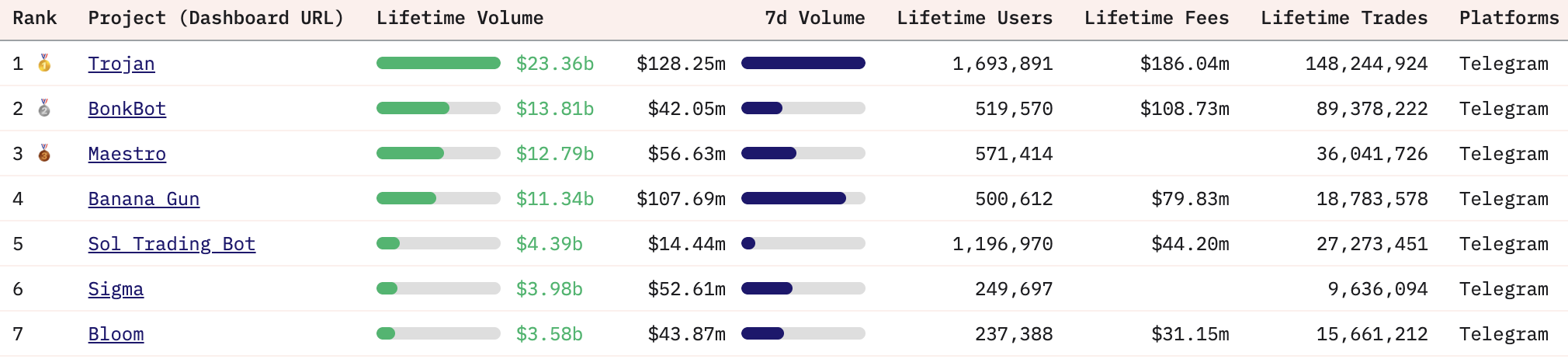

Trading web app platform are a niche, a highly profitable one. Before the web app, there was first few telegram bot. It was essentially built to help you snipe newly hyped tokens, but the onboarding wasn't easy, and it lacked a lot of information.

Quick check on the Telegram bot market and their revenue:

January 2024, Photon revolutionized the game by being the first trading web app. It quickly became the "Binance for Solana memecoins", though not decentralized. Who cares? It answered a real need.

Users flooded in, and volume exploded. Photon hit $44b in lifetime volume, with some days peaking at $600m/day, that represent $6m/day of revenue.

The business model? Simple!

1% fee on every transaction. The more volume you trade, the more revenue the platform makes.

Naturally, this attracted competitors - BullX, then Gmgn, and more recently, Axiom.

What's interesting is how BullX and Gmgn managed to grab market share from Photon with a simple Referral systems.

Well... not that simple.

Even though Photon didn't have the most generous referral system, many KOLs were still earning solid revenue through it.

So BullX and Gmgn had to come up with real deals to lure top KOLs over their platforms.

It could be a monthly payment or a fat 6 figs upfront.

Many KOLs, streamers, and content creators have mode huge amounts of money, thanks to affiliate deals.

The more they tweet and create content about BullX, while pushing their referral link, the more money they make.

That creates a strong flywheel effect.

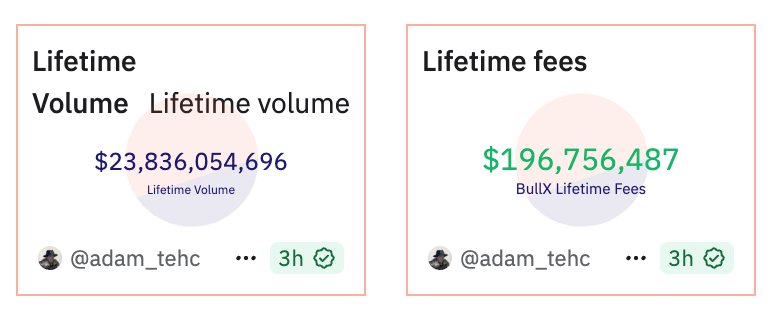

And that's how BullX reached $200M in lifetime fees.

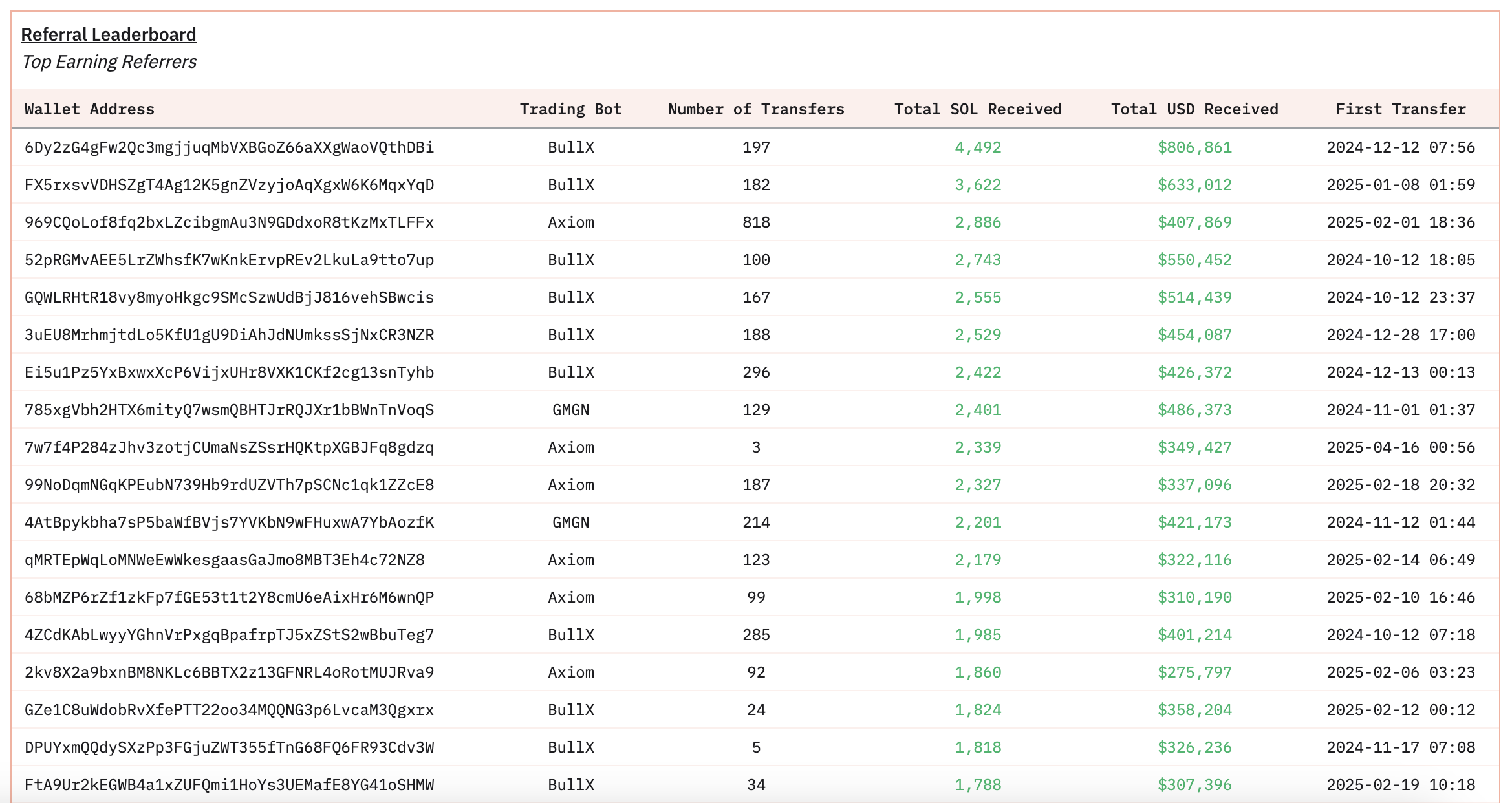

Referral Leaderboard

How Axiom surpass their competitors

Photon didn't gave a very developed GTM strategy.

They had the luxury of being first to the market, growing organically, with some hint regarding an airdrop that will probably never happen.

It was just a low-cost strategy to attract users.

BullX and Gmgn, on the other hand, had no choice but to approach their GTM differently if they wanted to grab some market share, especially since, apart from a few different features, it's still just a trading web app.

So how did Axiom outperform the competition?

It comes down to one simple sentence: A masterfully executed GTM and Product strategy. I will describe it into 3 chapter.

- Axiom: 40 trades/day with $4k average volume/user

- Photon/BullX: 10 trades/day with $1k to $1.6k volume/user

- Incentives

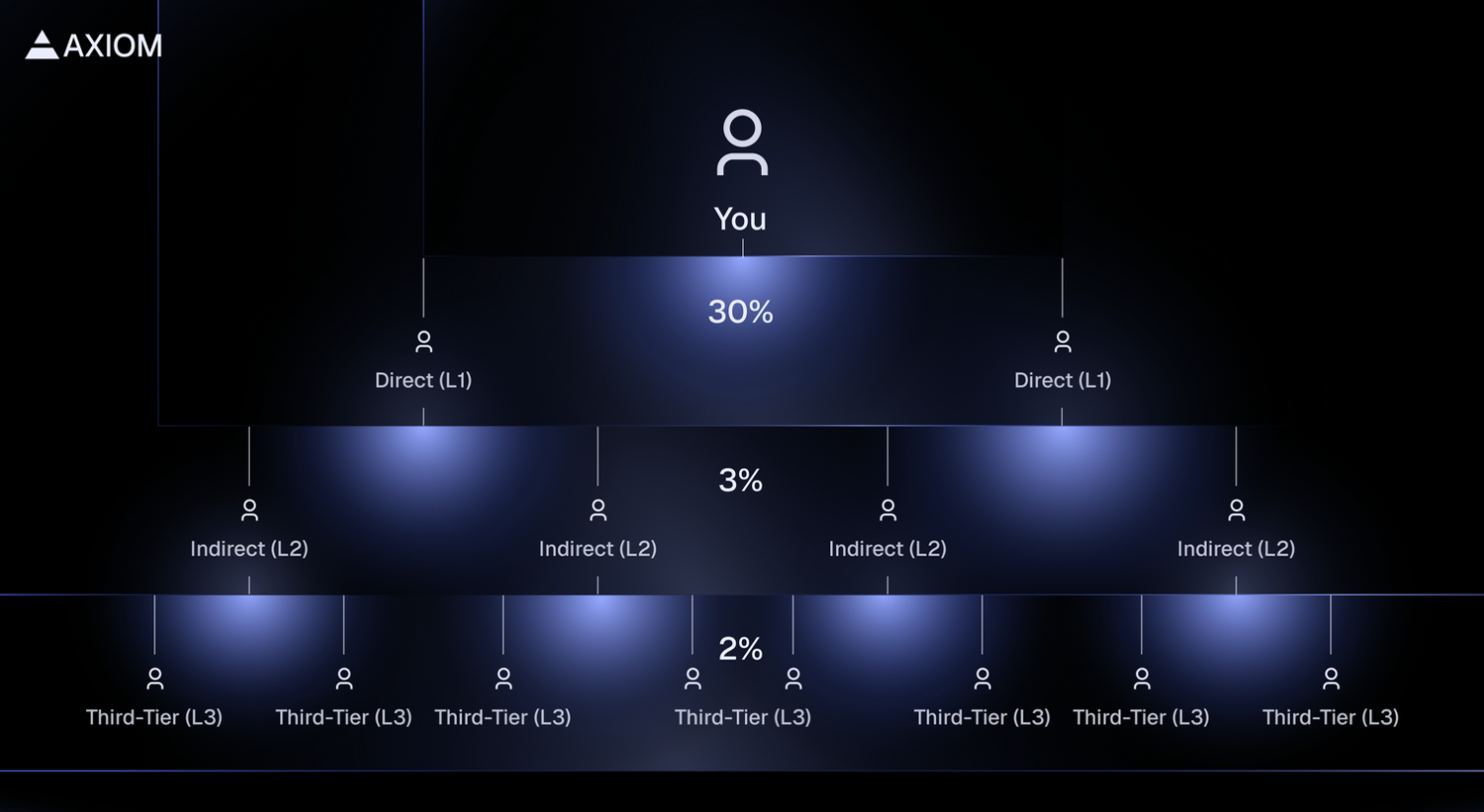

Axiom didn't just partner with KOLs, they built a real multi-layered referral system.

KOLs earn way more from their referral links on Axiom than they ever did on Photon, BullX, Gmgn or any other platform.

The average across platforms used to be around 10%.

Axiom changed the game with a structure that gives:

- 30% on the first layer

- 3% on the second layer

- 2% on the third layer

With this system, they've built a digital army that basically replaces their marketing department. The best part? It's still hugely profitable for them while earning more market share versus their competitors.

- Cashback program

Who really cares about cashback programs?

Most of the time, they offer 3%, maybe 4%, basically nothing.

But once again, Axiom surprises us.

Just like Duolingo, the longer your streak is, the higher your cashback.

It creates a level of user retention that other platforms simply don't have - or late to implement it. And more importantly, it gives users the unique feeling that they're actually making money every time they trade on Axiom.

I've talked to tons of users from these platforms, none of them has any idea how much they've spent in fees. None.

And yet... that's the core of everything.

Cashback is just a system that redistributes a part of the revenue you generated for Axiom, not the other way around.

It's a brilliantly executed mind game.

- Product

The product is a big part. Axiom's founders have been absolutely flawless in their product approach.

The foundation of the platform is solid, but man, the platform feels insanely fast overall, and the buy/sell orders part...

Add to that a near-perfect feedback loop, and you get a product that evolves exactly in sync with its community.

When you log into Axiom, the first thing you'll see is a lost of new features - requested by the community.

Jump into their Discord and you'll find countless discussions around feature ideas and bug reports.

But there's one thing I really want to focus on here:

SPEED.

Axiom hacks our brains, once again.

On most platforms, you get the notification after the transaction is confirmed on-chain.

On Axiom?

You get it instantly.

But here's the trick:

The transaction hasn't actually hit the chain yet.

The execution order is confirmed, yes - but not the full tx.

And you know what?

It doesn't matter.

The user doesn't see that. What they feel is pure speed.

"I can't leave Axiom anymore. I'm making money from my trade (whatever my PnL), the platform is insanely fast, and the referral system is super rewarding."

That feeling of speed is unmatched.

And for highly active traders, those who buy and sell within seconds, it's exactly what they need to see. I click on sell, I receive my notification, directly!

Or at least, this is what they think, but also need!

Because the truth is: on the back-end, all the platforms are more or less with the same speed.

The real difference?

Axiom nailed the front-end experience.

Conclusion

By cutting their margins compared to the competition (65% Axiom vs 85% market), Axiom earned the #1 spot and they fully deserve it.

The real question now: Will they be able to build long-term user retention? Something neither Trojan, Bonk, Photon, BullX, nor Gmgn have figured out so far.