Why Financial Institutions coming onchain now?

For years, crypto have been perceived as a giant casino. Since 2021/2022, the spotlight was on memecoins and celebrity tokens.

This is what creates the hype and the audience, but is it sustainable on long term? There was one big winner during this period: apps that charge 1% fees.

According to onchain Pumpfun statistic, only 3% of traders interacting with Pumpfun have made over $1000 in 2024.

Building an app related to memecoins was your best way to become a centi millionaire. The best example may be all the trading platform, especially Axiom who became the fastest YC startup that reach $100m in revenue in 4 months.

Aside of memecoins, we've seen the rise of prediction market, which have a real impact on the influence of news, making them much more accurate than before with polling institutes.

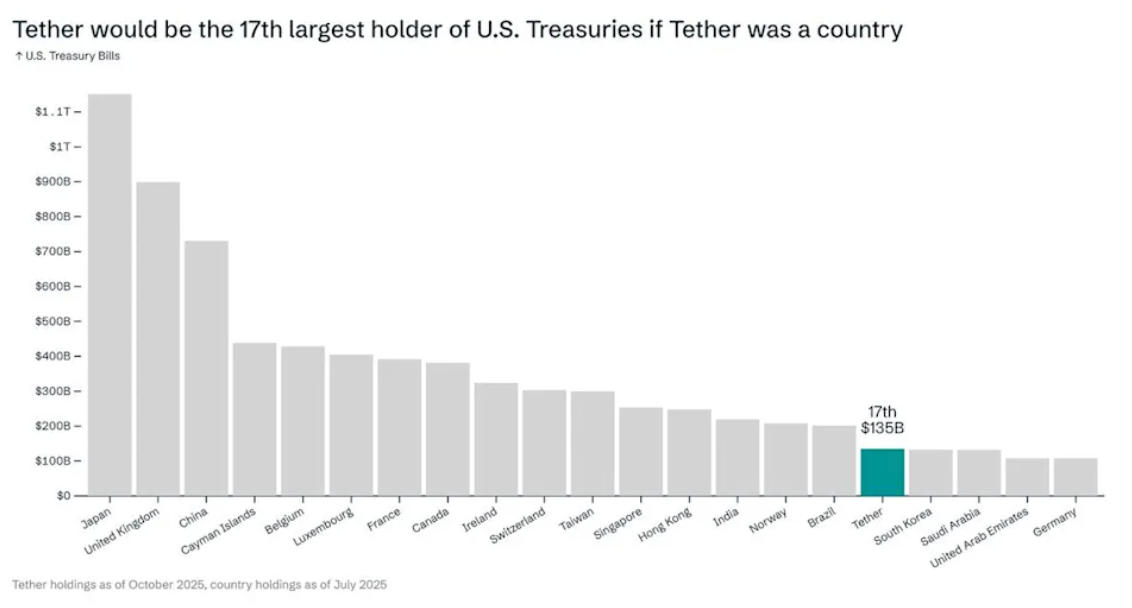

And how can we not talk about stablecoins? Who would have thought in 2017 that Tether would become the world's most valuable private startup, and that this same company would become the largest gold holder in the world (if we removed countries), holding more t-bills than South Korea, the UAE and Germany, while also recently making a public offer to buy Juventus Football Club? But the value of stablecoins is captured by one entity, retail cannot benefit from it (that may change...)

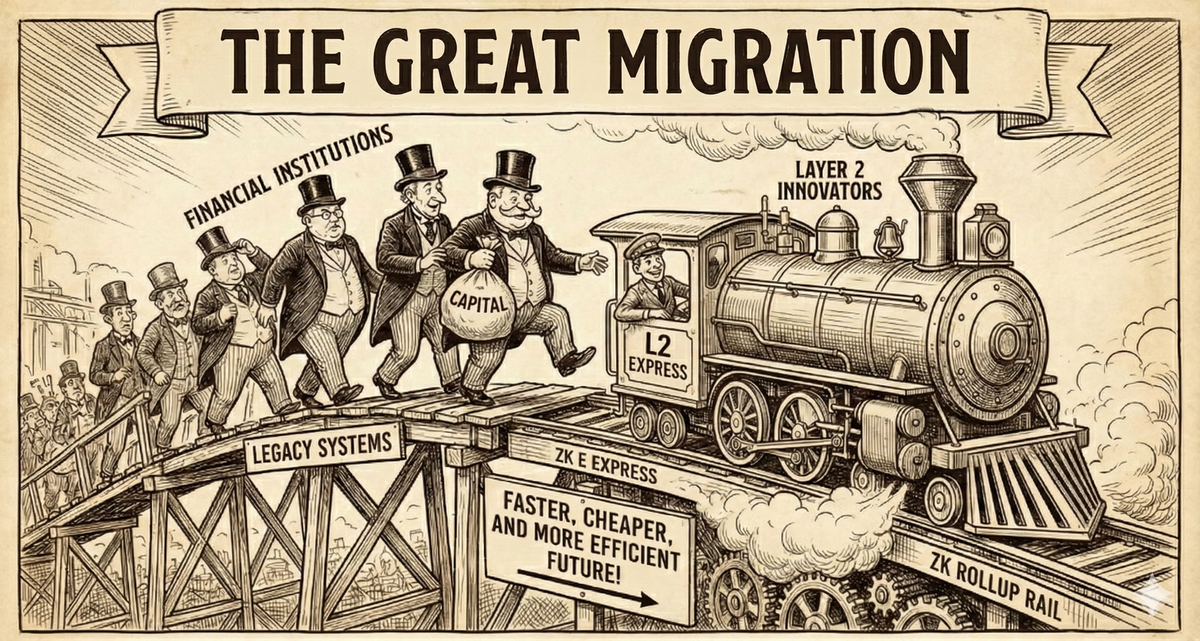

Until 2023, attention was clearly focused on memecoins, then stablecoin and then prediction marketing. This has been more discreet because it is not reflected in the price of tokens, but infrastructure innovation and research on Ethereum l2 has accelerated, particularly on ZK.

I love analogy, so I'll give a one: if PumpFun is the cathedral of the memecoin world, then Ethereum is the financial cathedral of the 21st century.

Ethereum has many advantages for institutions, making it increasingly attractive. It combine security, neutrality, audibility, reliability, liquidity and a depth ecosystem of layers 2 built on top of it, where it inherit from his security and add scalability, flexibility, customized environment, privacy and compliance features. Added to this, is the favorable regulatory context of recent months (MiCA / Genius Act - Clarity Act), that reduces the uncertainty for institutions in using and implementing these new technologies.

Part I

The maturity of the ZK tech accelerate the adoption of institutions

1/ The lack of onchain confidentiality has been the primary barrier preventing the migration of trillions in institutional assets. Banks cannot broadcast their trade strategies, liquidity positions, or customer identities to a public mempool for competitors to see. Imagine revealing all your clients information, including their positions, holdings, etc... besides kidnapping, there's also the fact that these clients could be approach by your competitors. So, financial institutions need privacy, but regulators demand transparency. ZK technology resolve this equation. It allows a party to prove that a statement is true (I have the funds and I am not on a sanctions list) without revealing the underlying data.

2/ Customizability and Control are central for financial institutions. Why? to understand this, you'll need to know what exactly are financial institutions. For me, the most accurate definition is this one: "they are public or private institutions that fulfill an economic or financial mission and provide financial services to their clients." Therefore, they need to be able to customize their execution environments according to their business needs. Today, L2s allow access to Ethereum security with more throughput than L1 mainnet & custom execution rules. They are agile and fast, but each of them will have their own specializations to respond most accurately to the demands of their partners.

3/ Financial institutions have legal obligations to several third parties, particularly regarding compliance, auditability, and reporting. Total privacy is not feasible but the selective auditability offered by ZK is optimal. Institutions can generate ZK-proofs that demonstrate they are compliant with capital requirements or KYC/AML regulations without exposing their entire customer database and regulators can be granted "view keys" to specific shards or transactions, ensuring that while the public cannot see the data, the appropriate authorities have the necessary oversight.

4/ GDPR accepts a "right to be forgotten" which customers can exercise with their banks. But the banks are legally required to retain certain data for years for anti-money laundering purposes, to provide proof of transactions, for tax compliance, and etc. In fact, this is not a complete erasure: banks must be able to stop certain uses (marketing) while retaining the data necessary to meet their regulatory obligations. This need data inventories and complex processes. Regulations - in certains countries - also require that certain financial or personal data be stored and processed within their territory, or under strict conditions for cross-border transfers. For a large bank operating in multiple jurisdictions, this need multiplying data centers or local cloud configurations, segmenting data flows, and managing sometimes conflicting regulations, which significantly increases costs and operational complexity. Data storage is one of the sine qua none condition for FI. ZK allows for offchain data storage with onchain verification. Institutions can keep sensitive data in secure, local databases and only post the ZK-proof to the blockchain.

Part II

Are the alternatives credible?

It is true that several L1 and Sidechains want to take a different path which may lead them to a little more performance and custom features in the short term, but remains a difficult choice to assume for several reasons.

First, Ethereum has the largest developer and research base in crypto, enterprise ready tooling, 1 million of decentralised validator, zero downtime since its creation, and unmatched security. These are the key qualities that institutions also wants and that they won't find in other L1s.

A L1 or sidechain can be compatible with the EVM, but it will not inherit from the Ethereum mainnet security layer like L2s. They need to develop their own validator database, which must be decentralized, numerous, and secure otherwise they may face censorship or fraud which is a strong no-go for any serious business who wants to come onchain.

L2s are a natural extension of Ethereum and integrate seamlessly with Ethereum's security and infrastructure but not all of them are equivalent in many aspect. Linea for example stands out for its 128-bit security and its strict equivalence to Ethereum by arithmetizing directly the EVM instead of running RISC-V in a client.

The main tradeoff regarding the 128-bits security is the large proof size. By H1 2026, proof sizes will drastically decrease to <300 klB, and Linea will be within the targets set by Ethereum Foundation. The main tradeoff of arithmetizing the EVM is that it's complicated to upgrade in Real-Time with L1 as it require very specific skills and many hours of work. Linea has just demonstrated in October with Fusaka, that it is feasible. With zkAssembly, Linea will reduce drastically the manual work.

If you use an L2, you are trusting Ethereum mainnet. L2s are designed so that everyone can withdraw funds to Ethereum L1. This is called escape hatch. This is critical for every FI. Ethereum is the most decentralized permissionless L1 and L2 rely on it. There's also some stuff like finality timing, gas estimation and MEV protection that are very important for any L2s to embrace FI.

Part III

Revenue for Sustainability

We're in the 1990s of the internet age. Today innovators will be tomorrow leaders with some will make the right decisions and survive, others won't. This is a medium to long term game, not a short term one. To approach enterprise accounts (over 10,000 employees), you need a minimum of 6 to 12 months before closing a deal - that was the timeframe at Salesforce & IBM. You can double this TF for the implementation of the solution, depending on the complexity.

L2s will need to be innovative in how they create and capture value for their own sustainability, many possibility are already live: appchain licensing, value added services, revenue sharing, fees etc.

The "Revenue Meta" is a sign of a maturing industry. We are moving away from speculative infrastructure/app and those who don't care about revenue are essentially saying they don't care about their own survival. In contrast, those that prioritize a sustainable bottom line are building the only foundation strong enough to support the weight of global institutional capital with trillons that are waiting to come onchain because it's simply more efficient for their business.