Valuing Chaos: Why investing Pump.fun at $4B FDV isn't a crazy idea

TLDR:

- Pump.fun ecosystem marketcap sits at $4.09B (13.05)

- $4b FDV gives PUMP the same sticker price-to-revenue multiple as Coinbase in 2014.

- Platform still clears 192k daily active wallets despite a slow down memecoin narrative

Why it matters

Pump.fun is revolutionizing the crypto ecosystem. We've gone from a world where only devs could launch a token, to a point where even a 14 years-old can do it with just a few clicks. Since then, an entire ecosystem has emerged on Solana, giving rise to one of the wildest sectors in crypto: trading web apps like Axiom, Photon and BullX.

Recently, a war has emerge between Pump.fun and Raydium. Both platforms are aggressively competing on each other's turf in a battle for gaining more market share.

Few numbers regarding Pump.fun:

| Metric | Value | Date | Source |

|---|---|---|---|

| Ecosystem market cap | $4.09 B | 13 Jun 25 | CoinGecko (coingecko.com) |

| 24 h volume | $1.872 B | 13 Jun 25 | CoinGecko (coingecko.com) |

| 7 d DEX volume routed via Jupiter → Pump.fun | $915.1 M | 10 Jun 25 | Dune dashboard (Jupiter Aggregator) (dune.com) |

| Daily active wallets | 192,791 | 11 Jun 25 | Dune “Pump.fun Trending” (dune.com) |

| Tokens launched (last 20 d) | 59,497 | 12 Jun 25 | Dune “Pump.fun Trending” (dune.com) |

| Planned raise / implied FDV | $1 B / $4 B | 9 Jun 25 | Blockworks (blockworks.co) |

The narrative

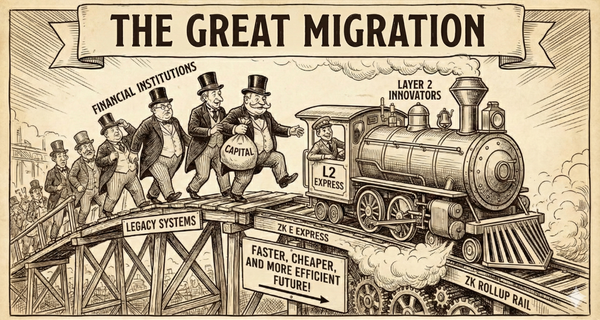

Problem → Opportunity

A $2 cost-of-creation, instant liquidity, and a bonding-curve that forces constant price discovery. The result is supply-side content (tokens) that doubles as demand-side engagement (traders). Since 2023 on the market, every new tokens that are VC-backed struggle to perform. For a retail user, there's no money to make on the secondary market (CEX platforms). Focus shift from real utility project to memecoin for this particularly reason. Also, KOLs make much more money with this narrative, thanks to referral links and marketing budget (tokens) that is giving to them.

Think of Pump.fun as Shopify for tokens

Users upload a logo and ticker, the contract mints the fully supply and seeds a micro-AMM. Swap fees (1%) for Pump.fun. If the coin hits a $90k marketcap, liquidity graduates to PumpSwap, the next DEX from Pump.fun. This vertical loop: mint → trade on Pump.fun → graduate Pump.swap. Pump.fun captures fees at every stage. The upcoming $PUMP token promising holders a share of swap fees across 11m+ tokens.

Future angle

Three trend lines converge:

- Fee trajectory. Even after memecoin mania cooled, pump.fun still clears $7m weekly in fees, enough to float a 5-8% real-yield at a $4B FDV.

- Reg-tech moat. If the Safe Harbor bill survives the Senate, fair-launch platforms get a de-risk badge US. Expect copycats on other L1s / L2s (ie: Virtuals).

- Liquidity migration. Capital is looking for yield. If Pump.fun shares fee-revenue on-chain monthly, expect a dividend-style narrative that could legitimize meme markets in institutional decks. If not, a buy-back program.

Risks & unknowns

- Bot domaine (93% top wallets) watch ration of human wallets/dat (Dune). A spike down signals retail fatigue.

- Regulatory flip-flop: Senate killing Safe Harbor would nuke FDV.

- Liquidity vacuum: If >50% of Solana DEX volume concentrates on PumpSwap (now 32%), smaller pools may collapse.

- Rug density: Solidus Labs flagged 98% Pump.fun tokens as scams.