Hyperliquid

HyperEVM is the most asymmetric opportunity in crypto at the moment and likely will be for a few months.

Season 3 – airdrop #2

Historic timeline:

- Season 1 start from Novembre 1, 2023 - to May 1, 2024.

- Season 2 start from May 29, 2024 - to Novembre 27, 2024.

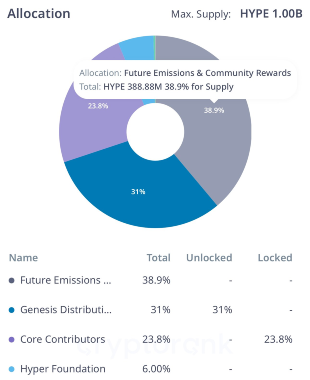

Tokenomics:

On official document, 31% of the tokens were allocated to the Genesis of Hyperliquid, the TGE. Another 38.9% will be for future points campaigns. Sounds good, right?

But it's even better! If we take in consideration the unclaimed rewards during the airdrop #1, we have 27% for Genesis, 42% for future campaigns.

At the current price of $HYPE, that's roughly $20 billion to be distributed. Twenty. Billion. Let that sink in.

There isn’t a single other project offering incentives this high. Not one. No one else even comes close, not even a 10% of what Hype is putting on the table.

Well, that doesn't mean everything will be distributed during the airdrop #2 – HyperEVM activities. But that help us to have a perspective.

Ecosystem:

All dApps, lending, DEXs, stables, LSTs, yield, options… they’re all fighting for market share. So, what’s the best way to win in a over competitive and new sector? Points campaigns leading to airdrops. It’s the new gold rush. History repeat.

New apps are popping up every day—each one a potential opportunity. They ask you to use their platforms, and in return, they reward you with their tokens. It’s a simple equation.

The key is betting on the right horses, the App that have the potential to go to the sky. Just like those who played Jito in 2023 or Jup in 2024. The game is about spotting the winners early and riding them all the way, while maximising your onchain print on HyperEVM. You are here to win, not visiting.

Right now, most of these apps are sitting at 5k to 15k users. Competition? Almost non-existent. As of today, you’re likely in the top 1%, maybe even 0.1%. Things will change when the HL team will announce the Season 3.

The friction to enter HyperEVM ecosystem is real. It's complicated, which keeps the newcomers out. That's your edge and that's what reducing the competition.

First advice: do not use bot, multi-wallet or any kind of it. You will be detected. Onchain analysis, address behaviour, address connections/bundled, synchronized actions – in 2025, we can see it all.

Explore the ecosystem naturally, especially if you’re new. Don’t force it. If you want to go deeper, follow my recommendations below (as of May 26th) to maximize every interaction. This isn’t a game of chance. It’s a game of strategy.

My goal & playbook

My goal with HyperEVM is a 6 figures airdrop.

Start by deposing native SOL on Hyperliquid

- Go here → Click on "Deposit" → Select Arbitrum and and send your USDT/USDC to Hyperliquid.

- Alternative to bridge and move-in your assets on Hyperliquid:

- HyperUnit to transfer your SOL to Hyperliquid

- HyperBridge to transfer many assets to HyperCore/HyperEVM

- HyperSwap to transfer many assets to HyperEVM

- Alternative to bridge and move-in your assets on Hyperliquid:

- Your stablecoin is directly on your perps account. Transfer it to spot account

- Buy spot $HYPE → Put 20% in staking → Go to Balance → Transfer to EVM

- Go to Chainlist, add HyperEVM network to your wallet

- Get wstETH from Sentiment, borrow HYPE against at 80% LTV

- Go to Harmonix, Delta Neutral HYPE Vault with up 15%

- Still on Harmonix, get some LHYPE (1000$)

- Go to Keiko Finance, borrow 50% of kei against your LHYPE (500$)

- Go to Valantis, swap it to HYPE and deposit into Valantis

Another strategy may fit better for you:

Hyperliquid has only interacted with 4 protocols on twitter since HyperEVM launched. These are the ones worth your time:

- HyperUnit, deposit native BTC, ETH, SOL & Fartcoin

- HyperDrive Defi, a stablecoin money market

- TheHyperliquidBridge: a bridge using LayerZero tech

- Felix Protocol: a lending platform