Stablecoins: A Trojan Horse in the Kingdom of Central Banks

Today, I want to talk about a topic the media sidessteps, technocrats eye with suspicion, and central bankers would prefer to see buried: stablecoins.

Why? Because behind the technical name lies perhaps the greatest threat, or opportunity, to the current monetary system.

Let’s start with the basics.

A stablecoin is a digital currency pegged to a fiat asset, usually the USD. It merges two worlds: the speed and freedom of blockchain technology, and the relative stability of fiat currency. It’s designed to maintain a 1:1 value with the dollar.

But here’s where it becomes interesting: this “dollar” doesn’t go through your bank, nor through your government. It moves across the internet. Borderless. Permissionless. Outside the traditional banking system. In essence, it’s a dollar that no longer follows the rules of Wall Street or the European Central Bank.

That alone is revolutionary.

While central banks print money from thin air to support bankrupt governments and zombified economies, stablecoins reintroduce monetary discipline. They are not dictated by political whim but by actual market demand.

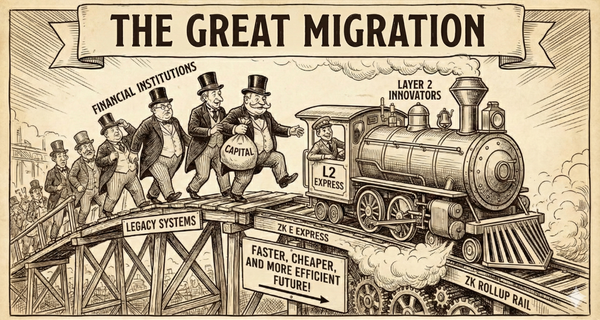

Even more important, they accelerate the disintermediation of finance. A stablecoin can be transferred in seconds, 24/7, with no SWIFT delays, no banking bureaucracy, no pointless forms. Try sending $100,000 through your bank on a Friday night and see what happens.

For entrepreneurs, investors, and anyone dealing across borders, it’s a lifeline in a system designed to slow you down and monitor your every move.

Of course, the establishment is worried. They scream about systemic risk, about regulatory gaps, about monetary destabilization.

But let’s be honest: central banks themselves are the biggest destabilizers of money today. They’ve suppressed interest rates, monetized public debt, and destroyed savings to prop up financial markets.

A well-designed, properly backed stablecoin offers a real alternative. It restores money to its original purpose: a neutral, reliable means of exchange, not a tool of policy manipulation.

And for those who still believe in monetary sovereignty, stablecoins represent a strategic opportunity. Imagine creating national or regional stablecoins not tied to the dollar, but backed by tangible assets: gold, energy, even productive output.

That could break the cycle of dependency on the US dollar, rebuild trust in currency, and relocalize economic power.

Stablecoins are not a passing trend. They are a signal, weak for now, that the monetary order is shifting. And for those who are paying attention, they represent an exit ramp, a way to preserve and build outside of the crumbling structure.

In a world where fiat currencies are losing credibility and public debt spirals out of control, the stablecoin is a flotation device.

What makes stablecoins even more powerful is that they come with a business model the banking world envies. When users deposit dollars to receive stablecoins, the issuer often holds that capital in short-term treasuries or cash equivalents, and pockets the yield. It's a form of modern seigniorage, but without the printing press or political games. In other words, they earn interest on your dollars, while offering you utility the banks no longer provide. Efficient, profitable, and global. It’s not just a currency innovation, it’s a direct competitor to the traditional deposit-taking model. And it’s winning.

Recently, many private companies announce to create their own stablecoin, even JPMorgan!

Let's take Revolut as an example: neobank with 50m customers. Is Revolut will be a serious competitor to Circle and Tether?

Revolut has a distribution advantage:

- 55M active retail customers, 500k business customers

- Present in 160 countries

- Crypto exchange with Revolut X

- Crypto support in their core product

In terms of revenue:

- $7.5b in stablecoin assets at current treasury yield that's +$300m annual revenue.

- Tether made $5.2B profit last year

- Circle has to give away most of its profit for distribution

- Revolut already own his distribution

Actually Tether and Circle leading the way, but many competitors entering this market.

Wire transfers around the world are now, as easy as sending an e-mail.