Linea: believe in somETHing

Let’s be honest. Yes, this title probably made you think of the Linea airdrop.

And yes, we’ll talk about it. But before that, we need to talk about something much more important for the long term: The tech behind Linea and its value proposition.

And why it represents a key milestone in the evolution of Ethereum, decentralization, and true digital ownership.

Why a Layer 2?

Blockchain technology has already transformed multiple industries, from financial markets to supply chains, identity, and gaming. But very quickly, a major issue appeared: scalability. We didn’t have a technological way to build a blockchain that is secure, decentralized, and scalable at the same time, on the same layer. Trade-offs were inevitable.

Ethereum’s roadmap introduced two main scaling strategies.

The first is sharding, where each node only verifies and stores a small portion of the transactions, rather than processing the entire chain.

The second is the Layer 2 strategy, networks built on top of Ethereum that inherit its security while handling most of the computation and data off-chain.

Over time, the Ethereum roadmap evolved to focus primarily on Rollups.

The Layer 1 (Ethereum) focuses on decentralization (blockchain’s core nature) and security (non-negotiable).

The Layer 2s focus on scalability: Ethereum’s biggest challenge.

I once read a metaphor that really stuck with me:

The judicial system (L1) isn’t designed for speed or efficiency. It exists to protect contracts and property rights.

Meanwhile, the entrepreneurs (L2) build on that solid foundation to push humanity toward AGI, robotics, and Mars.

Consensys

Consensys, founded by Joe Lubin, has one mission: to help Ethereum grow. They've done it with MetaMask, the most popular wallet in the Web3 space, and with Infura, the backbone infrastructure used by countless dApps.

In 2023, Consensys launched a zkEVM Layer 2 called Linea, designed to help Ethereum scale. Unlike many other L2s, Linea roadmap is fully dedicated to achieving 100% compatibility with Ethereum L1.

At the time I'm writing this article, Linea achieve it! 100% compatibility with Ethereum.

"Today, every second of your flight, every button pressed in the cockpit, every engine rotation is recorded and verified, leaving no room for doubt." - @goinfrexeth

This marks a major step forward in scalability.

Since most applications were originally built on Ethereum, they can now migrate to Linea and enjoy the best of both worlds and vice versa.

If you want to dive deeper into the technology behind Linea, I highly recommend the Linea Prover Documentation.

Feedback on Linea's Growth Strategy

I’m one of the many who completed almost the entire set of campaigns, from the early Linea testnet, to the mainnet launch, the various quests, and the Surge program.

My first feedback:

It was long. And not always that exciting.

My second feedback:

Linea built the most transparent reward system I’ve seen, thanks to the LXP model. There was zero room for insiders, and believe me, that’s been a real issue (even a meta) in many other projects over the past few years.

The testnet phase worked well overall. It brought visibility and credibility to the Linea ecosystem, especially for newcomers in DeFi.

I even onboarded some friends thanks to it.

Yes, at times it was slow, with lots of failed transactions and a faucet that didn’t always work but that’s to be expected when you have massive participation on a simple testnet. In fact, it helped create a solid stress-test for the network.

At the end, we received NFTs with different tiers. Nobody really knew what they’d be used for, there was a lot of speculation on the secondary market.

Eventually, these NFTs turned into LXP rewards, based on your actual testnet activity.

Personally, I think it was a great decision not to favor whales who bought hundreds of NFTs just to farm rewards. The system rewarded participation, not just capital.

Regarding LXP, the program was long. A bit too long, in my opinion.

Here’s why: I really enjoyed the first DeFi Voyage, even though it was costly at the time. Despite being a hardcore DeFi user, I discovered new apps, which made it worthwhile. What made this first phase special is that no one really knew if there would ever be a token or an airdrop. Because of the high cost per bridge and transaction, most of the big airdrop farmers didn’t jump in.

That gave a real edge to the early explorers.

The first Voyage was structured by segmentation, which worked. (week 1 bridge, week 2 DEX...)

But personally, I would have preferred a format with multiple missions and shorter story arcs to keep the pace dynamic.

To be fair, at that stage, the Linea team probably didn’t have visibility yet on a TGE timeline. So I can understand why they didn’t invest more time in polishing the campaign structure early on.

Linea Park

For many participants, myself included, this part of the campaign felt like it was done half-heartedly, for two main reasons:

First, we were promised a gaming-oriented experience. But in reality, 90% of the tasks were just minting NFTs. That was not interesting.

That said, we still discovered interesting NFT platforms like NFT2me, which positioned themselves as key players in the Linea ecosystem.

Second, this campaign took place during the EIP-4844, which drastically lowered gas fees. As a result, a huge wave of wallets started farming non-stop in the final days of the Voyage.

The earlier steps should have been closed or locked to prevent LXP dilution and protect against sybil farms.

Unfortunately, in the last 3 to 4 days, the platform became almost unusable due to the volume cause by Sybils.

Linea Surge

There are no bigger extractors in crypto than the LPs who provide capital during specific campaign windows.

It’s literally a deal that goes: “You provide us with $1M in liquidity, and you’ll get $XXXk in return.”

And here’s the thing: No project that has taken this approach has ever built a real community

The next day, that same LP moves on to the next protocol offering the same deal, often using the tokens you just gave them to farm elsewhere

What’s the result? A short-term boost that lasts a few weeks or months... in exchange for giving away precious tokens from your project

Is there any upside to this? Yes, one! You’re rewarding users who can’t sybil. That’s true. At what cost? Maybe worst.

I’m not sure what Linea plans to do with LXP-L, but in my opinion, it was a bad idea. Just like many other projects that chose a similar path.

You’ll see KOLs pushing this narrative on X and it’s easy to understand why. People holding hundreds of thousands or even millions in crypto, have zero incentive to test apps or chase airdrop campaigns for $100, $200, or even $5,000 as reward

But they do have a huge edge when it comes to depositing large liquidity into these campaigns, rather than letting their assets sleeping in low % APY protocols

In that context, I think zkSync’s TWAB approach (Time-Weighted Average Balance) was far more relevant. It rewarded long-term, passive commitment, over a meaningful time window.

If a user keeps their capital on Linea instead of moving it elsewhere, that’s a far stronger signal of alignment than anything generated by a high-intensity campaign like Linea Surge.

Anti-Sybils campaign

The Linea team and Nansen did an outstanding job. That level of execution is absolutely critical for every project that commit for a TGE, not just for the project’s success, but also to keep the balance between fairness and community satisfaction.

I even brought this up publicly in a conversation with the LayerZero CEO on X.

Because here’s the truth: Detecting Sybils isn’t an exact science.

And that puts us in a tough spot, a dilemma not unlike the one faced by the President of El Salvador:

I want to eliminate crime in the country (Sybils). To do that, I’ll punish everyone. If a few innocent people (non-Sybils) end up in jail, that’s the unfortunate cost for the rest to benefit fully.

It’s harsh, but real. In the end, it all comes down to one thing: Equilibre.

In crypto, community is just as important as the technology itself.

If you end up putting too many innocent users "in jail", you’ll face a backlash, the kind of marketing blowback no project wants.

During the mainnet campaigns, participants had to complete a Proof of Humanity through partner platforms in order to receive their LXP rewards.

But I strongly suspect that some of these partners intentionally lowered their validation criteria, just to drive more volume, and more fees, through their own apps.

Was an anti-Sybil campaign necessary? Absolutely.

I even wrote a full analysis on it here.

The high-risk window was obvious for Sybils, right after EIP-4844 went live, and more specifically, between April 2nd and April 4th, 2024.

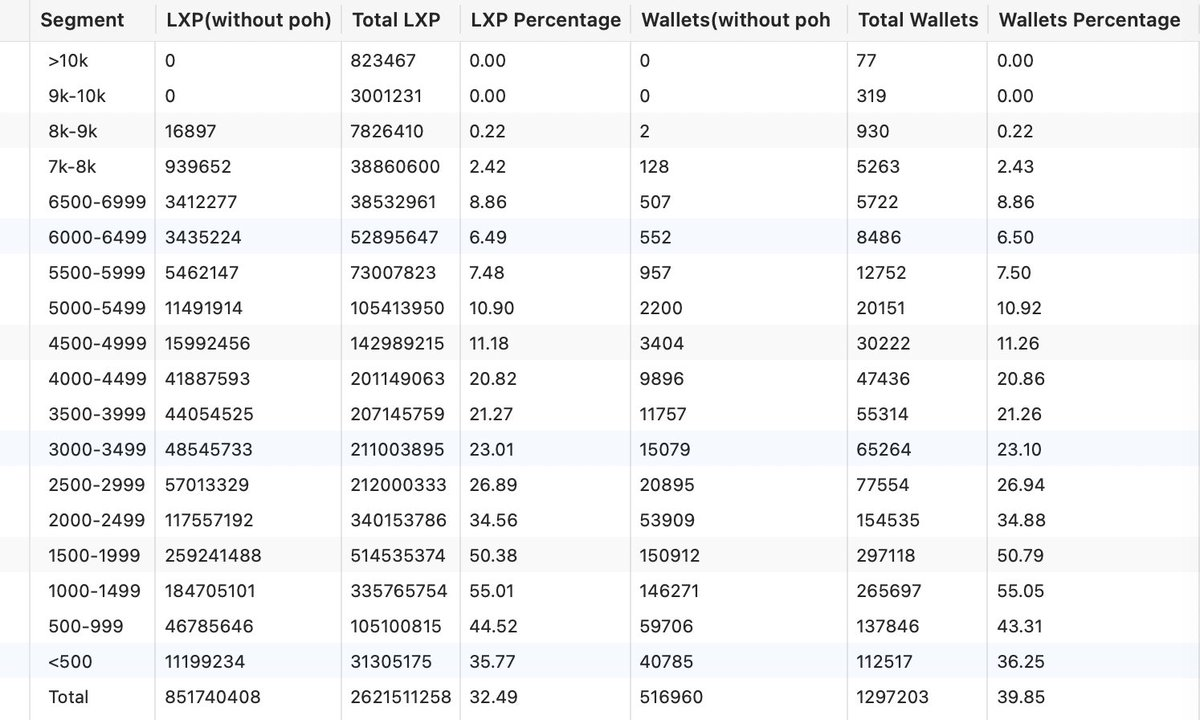

Results of the Anti-Sybils campaign

Before the Sybil hunt:

→ LXP: 2,621,511,258

→ Holders: 1,297,203

→ Average: 2,021

After the Sybil hunt:

→ LXP: 1,769,770,850 (-851,740,408 LXP | -32.49%)

→ Holders: 780,243 (-516,960 holders | -39.85%)

→ Average: 2,268 (+247 LXP | +12.23%)

The average holding increased slightly because most of the wallets flagged as Sybils had less than 2,000 LXP.

So, I analyzed 2,000 random wallets from the 800k who was on this list

My findings:

→ 6.45% | 129 out of 2,000 wallets from LayerZero initial Sybil list are eligible for Linea airdrop

→ Total LXP for these 129 wallets: 299,634

→ Average: 2,322 LXP/wallet | +2.38%

If we extrapolate those number to the entire eligible wallet on Linea, we get:

→ Number of eligible wallets (LXP): 729,906

→ Total LXP: 1,652,897,036

→ Average: 2,264 LXP/wallet

As you can see the difference is very small. But I still find some gems wallet that are eligible, but have less than two dollars in their wallet - across all networks. It could be a criteria - or no - that why I think TWAB is a good thing in general, to not use the same way as StarkNet did in the past.

To conclude: kudos to Linea and Nansen for executing a solid work on the Sybils analysis. The vast majority of wallets have been identified as sybils.

Airdrop Eligibility

I recently shared a points-based system on the Linea forum, inspired by what Arbitrum did, but with key differences. While the criteria are obviously not the same, I believe this model is the most robust, satisfying, and fair for the community.

The idea is simple:

The more you actively participate in Linea and its ecosystem, whether through LXP, LXP-L, Consensys products, or by being part of the Linea-native communities like Foxy and Efrogs (the most well-known, among many others), the more points you earn, and the higher your final allocation.

Why this model:

- Wallets that joined during Linea Park won’t necessarily be disqualified if they actively participated in Linea, especially with bonus & communities points linked to the Linea ecosystem.

- Sybils who only completed tasks during campaigns won’t receive the entirety of the governance tokens.

- This distribution method will satisfy the vast majority of the community.

Linea's Future & GTM

Once the token is distributed at TGE, Linea will need to focus on one thing: its competitive edge, and a clear vision for where the chain is headed.

While MetaMask has been a massive success on the retail wallet side,

Linea plays in a different space. Retail attention is currently dominated by Solana, Base, and now HyperEVM, which is gaining serious traction thanks to its strong community-driven focus. Catching up on that front will be difficult, even if the MetaMask Card ensures a steady stream of retail users flowing into Linea.

In my opinion, Linea should position itself as the go-to chain for institutions, where the real volume lives, not just in transaction count, but also in volume amount size.

Yes, it will take time and execution. But today, there’s no true “institutional chain” aside from Ethereum. Bitcoin plays the role of treasury hedge, not a decentralize infrastructure world.

Linea has a real shot at owning that vertical. That means going all-in on partnerships with banks, insurance companies, airlines, government services, and industrial giants

Using Ethereum, at scale.

To attract the right institutional partnerships, Linea will need more than just its zkEVM tech stack and 100% Ethereum compatibility. They'll need an elite Sales and BD team.

It also needs to secure a set of essential protocols to ensure the chain’s long-term sustainability. First on the list: a MetaDEX. We’ll likely hear more about it in due time. The fact that Joe Lubin himself has worked directly on this initiative says a lot about how strategic it is.

On a personal note, I believe Consensys should launch its own stablecoin. If the goal is to make Ethereum truly usable within enterprise networks, Consensys must offer all core infrastructure components, not just Linea, Infura, MetaMask, and the MetaDEX but also a native stablecoin.

A stablecoin would be one of the missing keys in that stack, critical for real-world payments, settlement, and interoperability within the Ethereum business layer.

Launching a native stablecoin would allow yield distribution to the Ethereum, Linea, and MetaMask communities, natively, and in a way that aligns with Ethereum’s long-term vision: decentralization and ownership.

We’re entering a new phase. The heavy lifting on the technical side is nearly complete. Now comes another challenge: Bringing the solution to the people who need it, even if they don’t know it yet.