Why and how raising money

A Historical Perspective and Practical Guide.

Startup funding might feel intimidating but it's a simple equation balanced between capital with ambition, expertise, and time. When I was younger, I naturally gravitated toward bootstrapping my journey. It seemed simpler, more direct. Yet, experience taught me that in fiercely competitive markets with ambitious goals and the need for rapid growth, bootstrapping alone often isn’t enough, and it's not the way to create something BIG.

Indeed, the concept of raising funds is far from new. As early as the Middle Ages and Renaissance, enterprising individuals sought financial backing to fuel bold ventures, much like startups do today. Merchants and explorers partnered with investors, sharing potential rewards, if the return home. Christopher Colombe famous voyages were financed by royal patronage from Spain, one of the first institutional backing.

By the 17th century, the funding landscape had evolved dramatically. Entities like the Dutch East India Company introduced similar mechanisms to today fundraising, allowing the public to purchase shares and share potential profits. These early ventures was the beginning of our modern equity and venture capital.

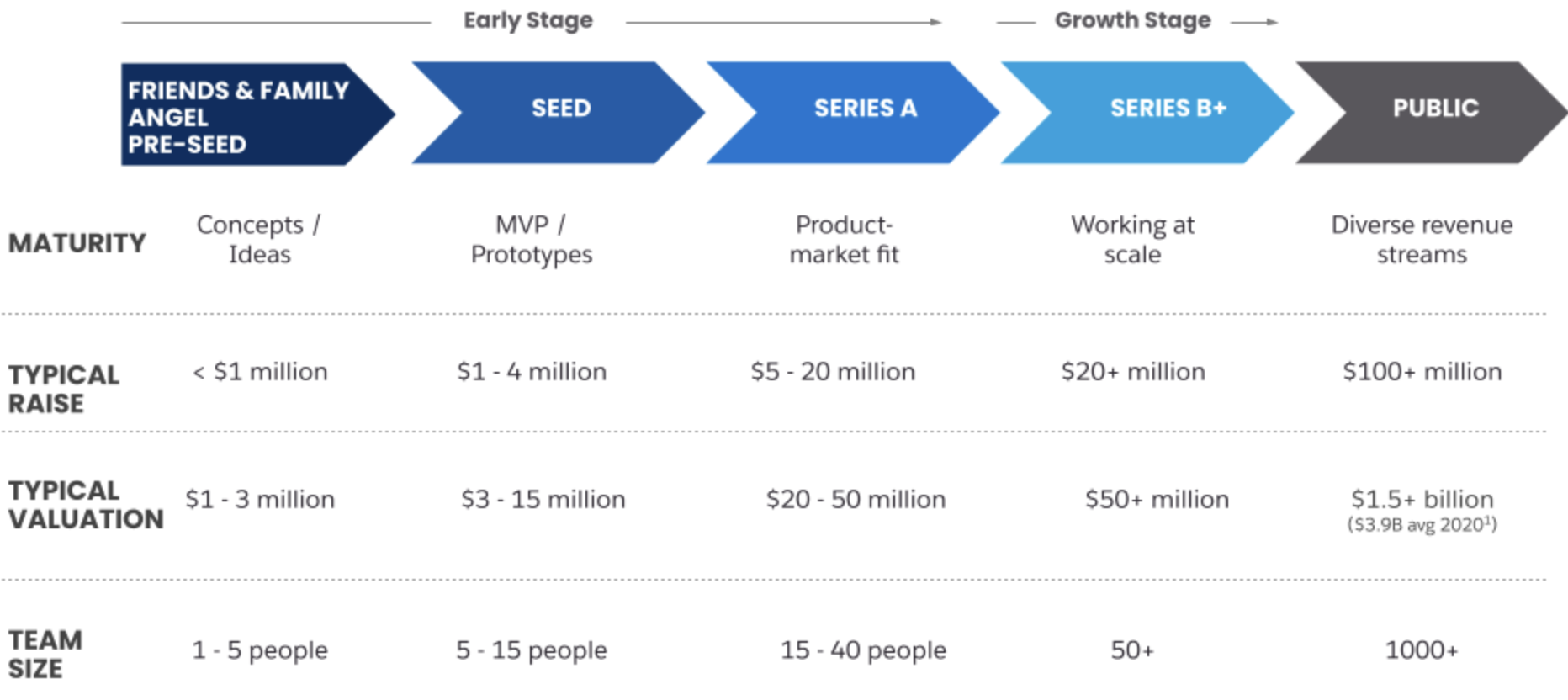

Today Startup Investment Stages:

- Pre-seed Stage:

Typically funded by founders, friends, family, or grants. The goal: validate ideas and establish a founding team - Seed Stage:

Involves angel investors, VC, incubators, and crowdfunding platforms. At this stage, startups focus on refining products and initial market entry - Series A:

Institutional venture capitalists step in, providing significant funds to scale operations and capture greater market share. Demonstrable market fit and clear growth trajectory are essential - Series B and Beyond:

With validated business models, startups attract larger investments to expand significantly and conquer new markets

The Startup Lifecycle

You can break it into two key phases: Early Stage and Growth Stage.

Alternative Funding Paths:

- Crowdfunding: Engaging the broader public via platforms like Kickstarter.

- ICO: Tokenise your project and raised money throughout the blockchain technology.

- Debt Financing: Loans from banks or specialized financial institutions.

- Revenue-Based Financing: Funding repaid through a percentage of revenue, suited to profitable startups.

- Grants and Subsidies: Non-dilutive financing from governmental or institutional bodies.

Keys to Successful Fundraising:

- Strong and Diverse Team: Essential skills, expertise, adaptability, and credibility. Experience is crucial, but not always requiert.

- Compelling Vision: Clearly articulated long-term vision and realistic roadmap. Show to your VC a way to exit. They're there to make money and reduce their risk.

- Market Validation: Proven traction, early adopters, and strategic partnerships. Big and strong logo's important.

- Consistency and Clarity: Uniformity across pitch decks, financial projections, and storytelling. Be prepared. You should imagine every situation, because the VC will ask them to you!

- Networking & Visibility: Building influential connections and a visible industry presence. Probably one of the most important. Create energy around you, make friends, be interested and interesting.

Let's finish with incubators:

- Advantages: Access to mentorship, strategic networking, structured guidance, and easier funding access. It may sound classic, but it's highly valuable.

- Considerations: They often require equity stakes, and selecting one aligned with your venture's goals is critical. If you got selected by a famous VC, you will be able to raise more with an higher valuation your Serie A.